Bankruptcy Lawyers Near Me Things To Know Before You Get This

Table of ContentsThe Buzz on Bankruptcy Benefits10 Simple Techniques For Bankruptcy Lawyers Near MeAn Unbiased View of Bankruptcy AustraliaThe Definitive Guide to Bankruptcy CourtBankruptcy Lawyers Near Me Can Be Fun For AnyoneNot known Details About Bankruptcy Bill

Leinart Law office would love to give information to make sure that you understand the details of both of these terms as well as the various other sorts of bankruptcy you need to be taking into consideration personal bankruptcy as a strategy. Borrower: the person or organization declaring bankruptcy. A debtor and partner can file a joint application in bankruptcy.

The Ultimate Guide To Bankruptcy Business

The borrower's crucial "obligation" is simply to be straightforward as well as participating throughout the procedure. Creditor: the person or business which has an insurance claim against a debtor. That insurance claim is typically simply for a quantity of money owed on a financial debt, but can likewise consist of commitments on a contract or for an injury that are not of a specific amount.

They have a tendency to be more entailed if they have collateral safeguarding their insurance claim, or have some individual axe to grind (such as ex-spouses as well as ex-business companions). Bankruptcy Staff: the individual, as well as all of his or her workers, that deal with the clerical facets of the insolvency court (bankruptcy attorney). These individuals accept your case for declaring, keep your bankruptcy file, and also handle the majority of the documentation involving your bankruptcy instance.

The Facts About Bankruptcy Lawyers Near Me Uncovered

Personal bankruptcy Judge: the person that is inevitably in fee of your instance. Bankruptcy judges are assigned to terms of 14 years. In most straightforward Chapter 7 and 13 cases, you will not have any type of celebration to fulfill the bankruptcy judge assigned to your case.

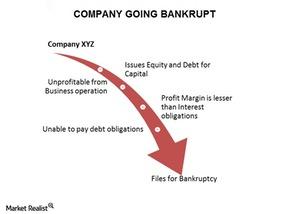

In lots of methods, bankruptcy can assist individuals and family members get a clean slate (bankruptcy australia). Below are some of one of the most common reasons individuals declare personal bankruptcy. Joblessness or a sudden reduction of income is an additional top reason individuals submit bankruptcy, especially if the borrower is the main company for their household.

3 Easy Facts About Bankruptcy Lawyers Near Me Explained

Minimum payments are made yet interest keeps building up. Quickly a $50 acquisition is now $150 due to interest and also late charges.

Based upon the details of your instance, you will wish to submit under a specific phase. The various personal bankruptcy choices are arranged right into different "Phases" based upon where each is found in the United State Personal Bankruptcy Code. Chapters 7 as well as 13 are largely made use of by people with tiny company or customer financial debt.

The Best Guide To Bankruptcy Benefits

quantity of consumer and/or business financial debt. This is mainly for companies. Chapter 9 is for city, county, and also various other governmental bankruptcies.Chapter 9: a restructuring of financial debts of a city, area, or various other neighborhoodof a state.Very couple of are filedduring the last 30 years approximately of this Chapter's existence, between only 1 to 18 cases have actually been filed per year.Chapter find here 11: a" reconstruction "of financial debts. It takes a whole lot of thought and also planning in order to identify if insolvency is appropriate for yourscenario. There are numerous factors why people pick bankruptcy and there are essential things to take into consideration. Below are a few points that you should consider when determining whether to file for bankruptcy. You have to be eligible for filing. This is identified by your debt, kind of financial debt, revenue, your capacity to pay, and other variables. If you talk with a personal bankruptcy attorney, they can offer you an excellent idea if you would certainly certify, as well as if not, what various other options are available for you. Nevertheless, being in debt can usually be even worse. Personal bankruptcy can help you get back on course monetarily; you simply have to weigh the benefits and also figure out whether it is the finest suitable for you. Over the last few years, a variety of sites, books, as well as do-it-yourself sets have actually shown up, offering suggestions and assistance in how to submit for personal bankruptcy without a lawyer. When filling up out types, it is important that the proper information be offered and also details lawful procedures stuck to.

More About Bankruptcy Business

In Texas, when you submit for insolvency you have to pick exemptions offered under government guidelines or ones supplied for under Texas state regulation. Individuals who submit by themselves can confuse these 2 and, because of this, checklist exemptions they are not entitled to under one or the various other set of guidelines. Also if you're just the co-signer on your kid's vehicle or on your senior mom's bank account, these can still be considered properties applicable to your personal bankruptcy declaring. Failing to understand this might need that you fix certain kinds, leading to delays and triggering various other court treatments. If you have an interest in declaring Phase 7, you'll require to complete a 6-page bankruptcy indicates test estimation. Nonetheless, these estimations are typically so complicated that a bulk of personal bankruptcy attorneys use unique software application to make certain the calculations are done correctly. If you make a mistake onyour Phase 7 indicates examination calculation, you could have your instance rejected or have your Phase 7 moved to a Chapter 13. For instance, if you owe cash on a bank card account, the credit card business can not seek collection activities against you. Your financial debt bankruptcy back taxes on the account will certainly be eliminated. If you submitted under Chapter 13, any type of house or vehicle debts( the quantity you lag)and any type of various other debt being managed with the personal bankruptcy will certainly be rolled right into the monthly payments collected by the insolvency trustee. It does not in as well as of itself clean out financial obligation. As such, if there is another person on any of the accounts selected for your insolvency, lenders can still go after lawsuit against them. For instance, if you as well as your spouseget on a charge card account and only you declare insolvency, the charge card company can still pursue collection activities against your spouse. Second, the credit rating record supplied to your employer will certainly not include your credit report. Third, your employer will certainly not be able to see account or credit history card numbers on your report but they will certainly see credit report card and also lending settlement histories, debt questions, collection actions, and also any kind of insolvencies or liens. If, for whatever reason, your employer is just one of your financial institutions, they will certainly be notified ultimately as part of your personal bankruptcy filing. Most significantly, nevertheless, it is against the law for a company to take activity against a staff member who has actually filed for personal bankruptcy. Even if your company in some way finds out that you've submitted for personal bankruptcy, under the regulation they can't do anything to you due to the fact that of your insolvency alone. There are some circumstances when an alternative strategy is the most effective service. At Leinart Law Office, we desire you to be too informed as possible to ensure that you can decide that is finest for you. There is a method you might have the ability to negotiate with your financial institutions as opposed to choosing for insolvency. Nevertheless, this does not provide any relief in the amount owed official statement to financial institutions, it does not stop the rate of interest from accumulating, as well as creditors can still call you or pursue legal judgments from you at any type of time. We can supply you with added information about credit scores counseling

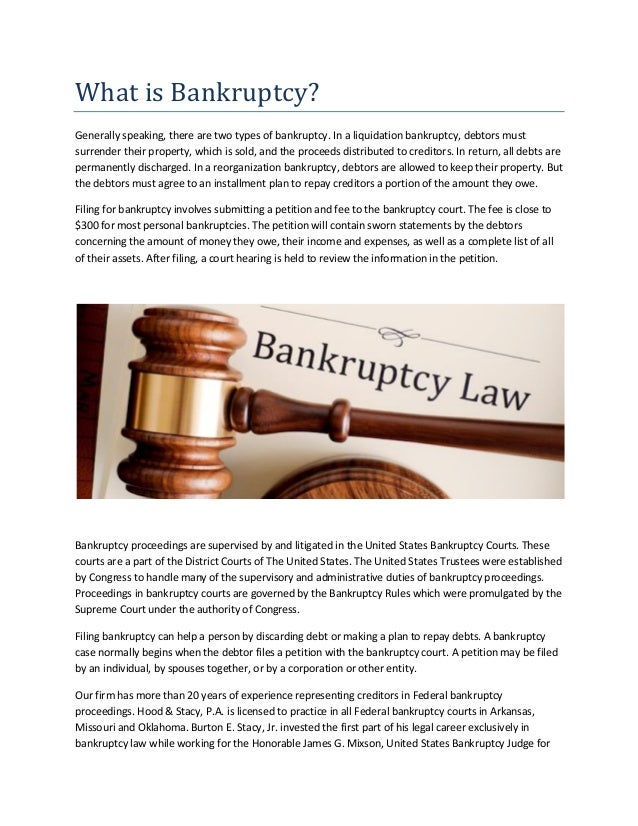

. Lots of credit scores counseling firms give financial debt administration services. The insolvency procedure is regulated by the Federal Policies of Bankruptcy Treatment(or the"Personal Bankruptcy Rules" )and the regional regulations of each personal bankruptcy court. The Insolvency Regulations have a set of main kinds for usage in bankruptcy cases. There is a personal bankruptcy court for every judicial district in

the nation. Much of the personal bankruptcy process is management, nonetheless, and also is performed far from the courthouse. In situations under phases 7, 12 or 13, and occasionally in chapter 11 instances, this administrative process is lugged out by a trustee, that is selected by the court to look after the situation. A debtor's involvement with the insolvency judge is usually very restricted.